|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should We Refinance Our Home Mortgage: Exploring Options and ConsiderationsUnderstanding Mortgage RefinancingRefinancing a home mortgage can be a strategic financial decision for homeowners looking to take advantage of lower interest rates, modify loan terms, or tap into home equity. However, the decision to refinance should be carefully considered, as it involves various costs and implications. What is Mortgage Refinancing?Mortgage refinancing involves replacing your current home loan with a new one. This process can potentially lower your monthly payments, reduce your interest rate, or allow you to cash out equity for other uses. Why Consider Refinancing?

Evaluating the Costs and BenefitsBefore deciding, weigh the costs of refinancing against the potential benefits. Consider factors such as closing costs, the break-even point, and long-term financial goals. Calculating the Break-Even PointThe break-even point is the time it takes for the savings from a lower interest rate to exceed the refinancing costs. To calculate, divide the total cost of refinancing by the monthly savings. Real-World ExampleFor instance, if refinancing costs $3,000 and reduces your monthly payment by $150, your break-even point would be 20 months. After this period, the savings continue to accumulate. When to Refinance?Timing is crucial in refinancing. Monitoring interest rates and understanding your financial situation are key. Visit when can you refinance a house for insights on timing. Factors to Consider

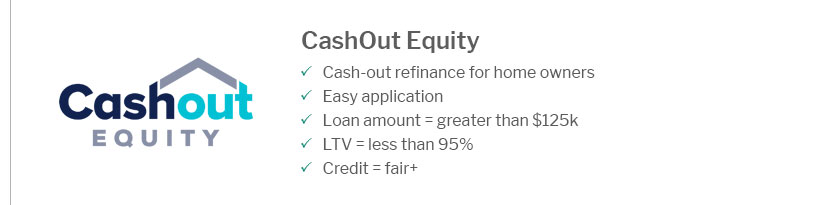

Choosing the Best OptionChoosing the best home refinance option depends on individual circumstances. It's essential to shop around and compare offers from different lenders. Working with LendersEngage with multiple lenders to understand the variety of available products. Look for competitive rates, favorable terms, and consider potential lenders' reputations. FAQsWhat are the typical costs associated with refinancing?Refinancing costs can include application fees, appraisal fees, title insurance, and closing costs. These can range from 2% to 5% of the loan amount. How does my credit score affect refinancing?A higher credit score generally qualifies you for better interest rates and terms. It's advisable to check and improve your credit score before applying. Is it possible to refinance with bad credit?While challenging, refinancing with bad credit is possible. Consider lenders who specialize in bad credit loans, but expect higher interest rates. https://www.cnbc.com/select/pros-and-cons-of-refinancing-home/

The most immediate benefit of refinancing is that it helps cash-strapped borrowers find space within their monthly budget. This could be advantageous if you ... https://www.investopedia.com/mortgage/refinance/7-bad-reasons-to-refinance-mortgage/

Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. https://www.reddit.com/r/Mortgages/comments/1eypieq/how_often_canshould_you_refinance/

You actually better off taking a lower rate without the credit. Refinancing resets the clock on the amortization schedule, so you are always ...

|

|---|